Objective;

This blog explains insurance broker website design, covering essential features, costs, and best practices, helping brokers create professional, user-friendly websites that build trust, attract clients, and generate quality leads effectively.

Insurance broker website design plays an important role in how clients find, trust, and choose your services online. Most people search for insurance information, compare policies, and request quotes through websites before speaking to a broker. A clear and professional website helps you explain your services, show credibility, and make it easy for visitors to contact you.

Did you know? More than 60% of insurance-related searches happen on mobile devices, making mobile-friendly design essential for capturing leads.

A good insurance broker website is more than just a good-looking design. It should include the right features such as easy navigation, simple quote request forms, mobile-friendly pages, and secure data handling. These elements help visitors understand your offerings quickly and feel confident sharing their details.

In this blog, we will explain insurance broker website design in simple terms. You will learn about essential features, website design costs, and best practices to follow. This guide will help insurance brokers create a website that attracts visitors, builds trust, and generates quality leads.

Table of Contents

- What Is Insurance Broker Website Design?

- Why Insurance Brokers Need a Professional Website

- Key Features of an Effective Insurance Broker Website

- Best Design Practices for Insurance Broker Websites

- SEO Best Practices for Insurance Broker Websites

- Why Mandy Web Design Is More Affordable Than Other Companies

- Factors That Affect Insurance Website Design Cost

- Custom vs Template Insurance Broker Websites

- How to Choose the Right Insurance Website Design Company

- Why Choose Mandy Web Design for Insurance Broker Websites

- FAQs About Insurance Broker Website Design

What Is Insurance Broker Website Design?

Insurance website design refers to the process of creating and structuring a website specifically for insurance brokers and agencies. It involves planning the layout, choosing colors and fonts, organizing content, and adding features that help visitors find information and request services easily.

Unlike general business websites, insurance broker websites need specific elements. These include quote request forms, policy comparison tools, client testimonials, and clear explanations of different insurance products. The design should make complex insurance information easy to understand for everyday visitors.

A well-designed insurance broker website serves multiple purposes. It educates potential clients about insurance options, builds trust through professional presentation, captures leads through contact forms, and provides existing clients with resources and support. The design should reflect your brand identity while meeting the practical needs of people searching for insurance solutions.

The main goal of website design for insurance brokers is to convert visitors into leads and eventually into paying clients. Every element on the page should guide visitors toward taking action, whether that means requesting a quote, calling your office, or scheduling a consultation.

Why Insurance Brokers Need a Professional Website

The insurance industry has changed significantly over the past decade. Today, more than 80% of insurance buyers research online before making a purchase decision. If your website looks outdated or difficult to use, potential clients will move to your competitors who have better online presence.

A professional website establishes credibility immediately. When visitors land on a clean, modern, and well-organized website, they perceive your business as trustworthy and established. This first impression matters greatly in the insurance industry where people are trusting you with important financial decisions.

Professional insurance website design helps you compete with larger insurance companies. While you may not have the same budget as big corporations, a focused and well-designed website can showcase your local expertise, personalized service, and specialization in specific insurance types. These advantages help you stand out in your market.

Your website works for you around the clock. Unlike your physical office that has set hours, your website is available 24/7 to answer common questions, collect lead information, and provide resources to potential clients. This constant availability can significantly increase your lead generation without requiring additional staff.

A professional website also improves your marketing efficiency. When you run advertising campaigns, send email newsletters, or post on social media, you need a central destination that converts that traffic into leads. A well-designed website serves as this conversion hub, making all your other marketing efforts more effective.

Key Features of an Effective Insurance Broker Website

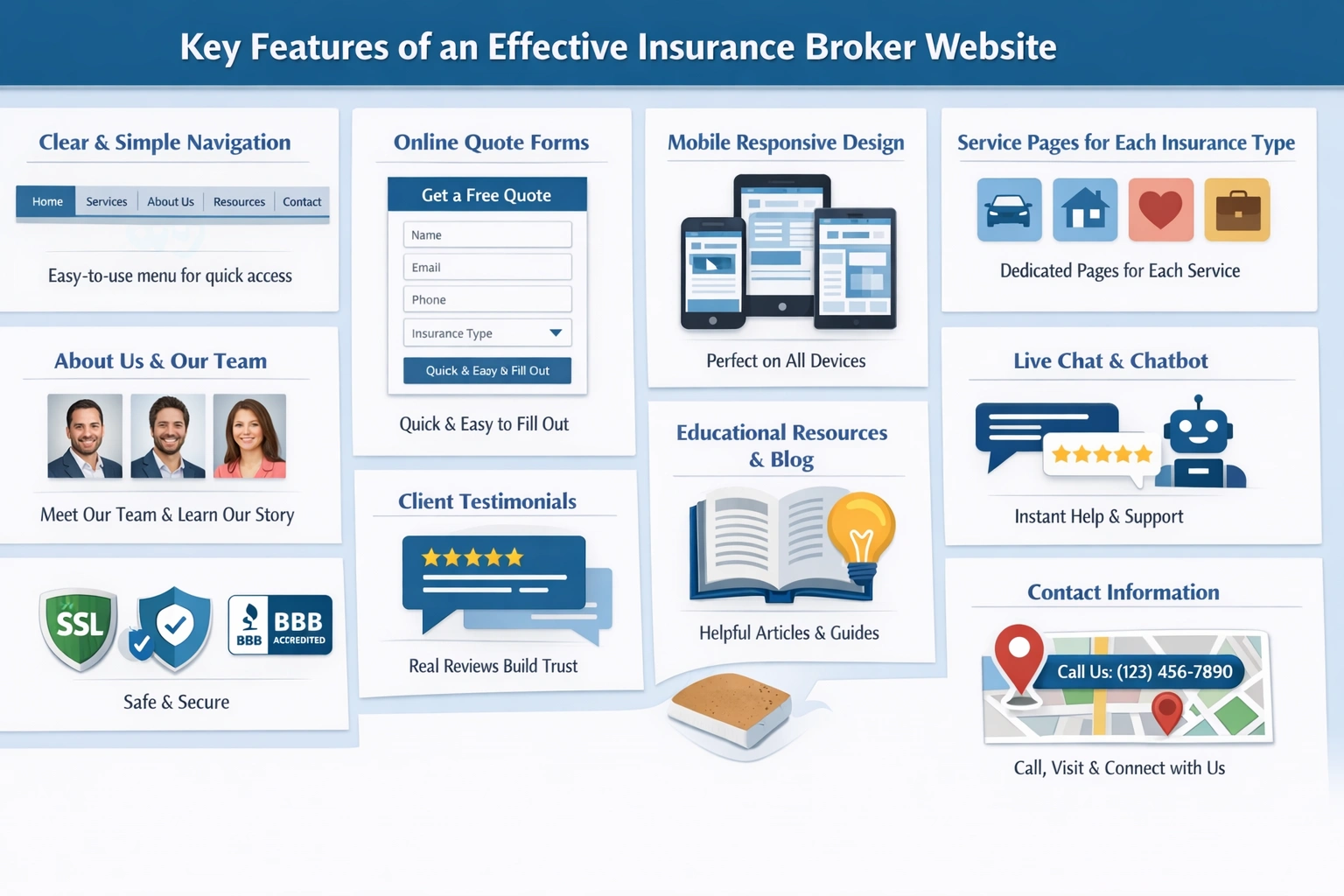

An effective custom insurance website design must include several essential features that address both user needs and business goals. These elements of web design work together to create a seamless experience for visitors while helping you generate and manage leads efficiently.

1. Clear and Simple Navigation

Your website navigation should be straightforward and intuitive. Visitors should find what they need within three clicks. Use clear menu labels like “Home,” “Services,” “About Us,” “Resources,” and “Contact.” Avoid industry jargon in your menu items that might confuse everyday visitors.

2. Online Quote Request Forms

Quote request forms are critical for capturing leads. These forms should be easy to find, preferably in multiple locations throughout your website. Keep forms short initially, asking only for essential information like name, email, phone number, and type of insurance needed. You can gather detailed information later in the process.

3. Mobile-Responsive Design

More than 60% of insurance searches happen on mobile devices. Your insurance agency website design must be mobile responsive and work perfectly on smartphones and tablets, which is essential to improve website UX for on-the-go visitors. This means text should be readable without zooming, buttons should be easy to tap, and forms should be simple to fill out on small screens.

4. Service Pages for Each Insurance Type

Create separate pages for each type of insurance you offer, such as auto insurance, home insurance, life insurance, and business insurance. Each page should explain coverage options, benefits, common questions, and include a call-to-action button for requesting quotes.

5. About Us and Team Pages

People want to know who they’re working with, especially for important decisions like insurance. Include detailed information about your company history, mission, values, and team members. Add professional photos and brief biographies that highlight experience and qualifications.

6. Client Testimonials and Reviews

Social proof builds trust quickly. Display testimonials from satisfied clients throughout your website. Include real names, photos if possible, and specific details about how you helped them. Consider integrating reviews from Google, Yelp, or industry-specific review platforms.

7. Educational Resources and Blog

A resources section with helpful articles, guides, and frequently asked questions positions you as an expert. This content also helps with search engine optimization by targeting keywords people search for when researching insurance options.

8. Live Chat or Chatbot

Implement a live chat feature or automated chatbot following modern website design trends to answer common questions immediately. This instant communication can capture leads who might otherwise leave your website without making contact.

9. Security Features and Trust Badges

Since visitors will share personal information, display security badges, SSL certificates, and privacy policy links prominently. This assures visitors that their data is protected and handled responsibly.

10. Contact Information Display

Make it extremely easy for visitors to contact you. Display your phone number prominently in the header of every page. Include a physical address, business hours, and multiple contact methods. Consider adding a map showing your office location.

Best Design Practices for Insurance Broker Websites

Following proven design principles ensures your website is both attractive and functional. These insurance broker web design services best practices help create a positive user experience that encourages visitors to take action.

1. Use a Clean and Professional Layout

Avoid cluttered designs with too many elements competing for attention. Use white space effectively and choose web design layouts that make content easy to scan. Organize information logically with clear headings, short paragraphs, and bullet points where appropriate.

2. Choose Brand Colors Carefully

Select a color scheme that reflects professionalism and trust. Blue is popular in insurance websites because it conveys reliability and security. Whatever colors you choose, maintain consistency throughout the website to strengthen brand recognition.

3. Select Readable Fonts

Typography affects readability significantly. Choose fonts that are clear and easy to read on all devices. Use a maximum of two or three different fonts throughout your website. Make sure body text is at least 16 pixels for comfortable reading.

4. Include High-Quality Images

Use professional photos that relate to your services and target audience. Avoid generic stock photos that look artificial. Consider using real photos of your team, office, and local community to create authentic connections with visitors.

5. Create Strong Call-to-Action Buttons

Every page should have clear calls to action that tell visitors what to do next. Use action-oriented text like “Get Your Free Quote,” “Schedule Consultation,” or “Compare Plans Now.” Make these buttons stand out visually with contrasting colors.

6. Optimize Page Load Speed

Slow websites frustrate visitors and hurt search engine rankings. Optimize images by compressing them without losing quality. Minimize code, use browser caching, and choose reliable hosting. Aim for page load times under three seconds.

7. Implement Clear Visual Hierarchy

Guide visitors’ eyes through your content using size, color, and placement. The most important information should be the largest and most prominent. Use headlines to break up content and make it scannable.

8. Design for Accessibility

Make your website usable for people with disabilities. This includes providing alt text for images, ensuring sufficient color contrast, making the site keyboard-navigable, and using clear, descriptive link text.

SEO Best Practices for Insurance Broker Websites

Search engine optimization helps potential clients find your website when searching for insurance services. Implementing responsive insurance website design with an SEO-friendly website structure increases your visibility in search results and drives more qualified traffic to your site.

Keyword Research and Integration

Identify keywords your target audience uses when searching for insurance services. Include primary keywords like “life insurance broker in [city]” or “small business insurance quotes” naturally in your content, headings, and page titles. Avoid keyword stuffing, which can harm your rankings.

Local SEO Optimization

Most insurance brokers serve specific geographic areas. Optimize for local search by including your city and region in page titles, content, and meta descriptions. Create and optimize your Google Business Profile. Ensure your name, address, and phone number are consistent across all online listings.

Create Quality Content Regularly

Publish helpful blog posts, guides, and articles that answer common insurance questions. This content attracts visitors through search engines and establishes your expertise. Focus on topics your target clients care about, such as “how to lower home insurance premiums” or “what small business insurance covers.”

Optimize Page Titles and Meta Descriptions

Write unique, descriptive page titles and meta descriptions for every page. These elements appear in search results and influence whether people click through to your website. Include relevant keywords and compelling reasons to visit.

Build Quality Backlinks

Earn links from reputable websites by creating valuable content, participating in local business associations, and getting listed in insurance directories. Quality backlinks signal to search engines that your website is authoritative and trustworthy.

Use Schema Markup

Implement structured data markup to help search engines understand your content better. This can result in rich snippets in search results, showing your ratings, business hours, and other important information directly in search listings.

Optimize for Voice Search

More people use voice assistants to search for local services. Optimize for voice search by including natural language phrases and questions in your content. Create FAQ pages that directly answer common questions people might ask verbally.

Why Mandy Web Design Is More Affordable Than Other Companies

Understanding insurance website design cost helps you budget appropriately and set realistic expectations. Website costs vary significantly based on complexity, features, customization level, and the designer or agency you choose.

Mandy Web Design is more affordable than many other web design companies because we focus on what insurance brokers actually need, not on expensive and unnecessary features. Many agencies offer fixed packages with extra tools that increase the cost, even if they are not useful for your business. Mandy Web Design keeps the website simple, professional, and aligned with the latest UI/UX trends, which helps reduce overall pricing while improving user engagement.

Our web design pricing starts from ₹13,000, making it easier for insurance brokers to get online without a heavy investment. Other companies often charge high fees for basic design, while we provide essential pages, mobile-friendly layouts, and contact forms at a reasonable cost. We design websites that look professional and work well, without adding features that only increase the price.

Another reason Mandy Web Design is affordable is our transparent pricing approach. Many companies charge extra for small changes, updates, or basic support. We clearly explain what is included from the beginning and offer affordable maintenance options. This honest and flexible pricing helps insurance brokers save money while still getting a reliable and effective website. You can also hire a web designer from Mandy Web Design at just $10/hour, making it easier for insurance brokers to get expert support without a large investment.

Ready to Get a Professional Insurance Broker Website?

Partner with Mandy Web Design and start building a website that attracts clients, explains your services clearly, and generates leads effectively!

Factors That Affect Insurance Website Design Cost

Several variables influence the final price of your website project. Understanding these factors helps you estimate the cost to hire web designer and communicate effectively with designers or agencies offering affordable insurance website design.

1. Design Complexity

Simple, template-based designs cost significantly less than unique, custom-designed websites. If you want custom illustrations, animations, or complex visual elements, expect higher costs. The more unique your design requirements, the more design time and expertise required.

2. Number of Pages

A basic five-page website costs much less than a fifty-page website. Each additional page requires content creation, design, and optimization. Insurance brokers offering multiple service types typically need more pages to explain each offering adequately.

3. Custom Functionality

Standard features like contact forms and image galleries are relatively inexpensive. Custom functionality such as online quote calculators, client portals, policy comparison tools, or CRM integration requires custom development and increases costs substantially.

4. Content Creation

If you provide all written content, photos, and graphics, costs stay lower. If you need copywriting services, professional photography, or custom graphics creation, these content development services add to the total investment.

5. Third-Party Integrations

Connecting your website to other systems like customer relationship management software, email marketing platforms, or insurance quoting systems requires additional development work. Each integration adds complexity and cost to your project.

6. SEO Services

Basic on-page SEO is often included in website design packages. Comprehensive SEO services including keyword research, competitive analysis, ongoing optimization, and content strategy cost extra but provide significant value through increased visibility.

7. Experience Level of Designer or Agency

Freelance designers with less experience typically charge lower rates than established agencies with proven track records. While you might save money with less experienced designers, you may sacrifice quality, reliability, or strategic guidance.

8. Project Timeline

Rush projects typically cost more. If you need your website completed quickly, designers may charge premium rates to prioritize your project over others. Standard timelines of two to three months usually offer better value.

Custom vs Template Insurance Broker Websites

Choosing between modern insurance website design using templates or custom development depends on your budget, timeline, specific needs, and long-term goals. Both approaches have distinct advantages and limitations.

Template-Based Websites

Template websites use pre-designed layouts that you customize with your own content, colors, and images. Many website builders and content management systems offer insurance-specific templates. These are the fastest and most affordable option for getting online quickly.

Advantages of Templates:

- Lower initial investment, typically one thousand to three thousand dollars

- Faster launch, often completed in two to four weeks

- Proven layouts that work well for insurance brokers

- Regular updates and support from template developers

- Easy to manage and update yourself

Disadvantages of Templates:

- Less unique, similar to other insurance broker websites

- Limited design flexibility and customization options

- May include features you don’t need while lacking ones you do

- Can be difficult to significantly modify without developer help

- May not perfectly match your brand identity

Custom-Designed Websites

Custom websites are built from scratch according to your exact specifications. Designers and developers create unique layouts, features, and functionality tailored to your specific business needs and target audience.

Advantages of Custom Design:

- Completely unique design that stands out from competitors

- Perfect match to your brand identity and vision

- Includes exactly the features you need, nothing unnecessary

- Greater flexibility for future modifications and growth

- Better optimization for your specific business processes

Disadvantages of Custom Design:

- Higher initial investment, typically eight thousand dollars or more

- Longer development timeline, often two to four months

- May require ongoing developer support for updates

- Higher risk if you choose an inexperienced developer

- More complex project management and communication needed

Which Option Is Right for You?

Choose a template if you’re just starting out, have a limited budget, need to launch quickly, or run a straightforward insurance brokerage without complex requirements. Templates work well for independent brokers focused on local markets.

Choose custom design if you have budget flexibility, want to strongly differentiate from competitors, have unique features or workflows, operate a larger agency with multiple team members, or plan significant growth requiring scalability.

Many brokers start with templates and later invest in custom design as their business grows. This approach minimizes initial investment while providing a professional online presence, then allows for greater customization when budget and needs justify it.

How to Choose the Right Insurance Website Design Company

Selecting the right partner for your insurance broker website development significantly impacts your project’s success. Follow these guidelines to find a designer or agency that understands insurance industry needs and delivers quality results.

Review Their Portfolio: Examine previous insurance websites the company has designed. Look for visual appeal, functionality, and diversity in their work. Websites that load quickly, work well on mobile, and have clear calls to action demonstrate competence.

Check Insurance Industry Experience: Designers familiar with the insurance industry understand regulatory requirements, common user questions, and effective lead generation strategies. While not absolutely necessary, industry experience shortens the learning curve and improves results.

Read Client Testimonials and Reviews: Look for feedback from previous clients, particularly other insurance brokers or agencies. Pay attention to comments about communication, meeting deadlines, solving problems, and results achieved after launch.

Understand Their Process: Ask about their website design process. Good agencies conduct discovery sessions to understand your business, create mockups for your approval, provide regular updates during development, and offer training on managing your website.

Evaluate Their Communication Style: Clear, responsive communication is essential for successful projects. Notice how quickly they respond to your inquiries and how well they explain technical concepts in understandable terms. Poor communication during the sales process indicates problems ahead.

Discuss SEO and Marketing: Website design companies that understand search engine optimization and digital marketing provide more value than those focused solely on visual design. Ask about their approach to SEO, lead generation, and conversion optimization.

Compare Pricing and Value: Don’t automatically choose the cheapest option. Evaluate what each proposal includes, the quality of work shown in portfolios, and the level of ongoing support provided. Sometimes paying more upfront saves money long-term through better results.

Clarify Ownership and Access: Ensure you will own your website and have full access to all files, content, and hosting accounts. Some companies retain ownership or control, limiting your ability to make changes or move to another provider later.

Assess Ongoing Support Options: Websites require regular updates, security patches, and occasional troubleshooting. Understand what support is included after launch and what ongoing maintenance services are available at what cost.

Request References: Don’t hesitate to ask for references you can contact directly. Speaking with previous clients provides insights into working with the company that you can’t get from portfolios or proposals alone.

Why Choose Mandy Web Design for Insurance Broker Websites

Looking for a reliable and affordable web design company? Mandy Web Design helps businesses build simple, professional, and high-performing websites that create a strong first impression. With a focus on clarity, usability, and honest pricing, we design websites that help visitors trust your brand and take action without confusion.

Mandy Web Design is a full-service web design agency offering complete website solutions from start to finish. Our services include custom website design, UI/UX design, WordPress design, responsive website design, website redesign, and ongoing website maintenance services. This all-in-one approach ensures your website stays modern, user-friendly, and easy to manage.

We work with businesses across many industries, giving us the experience to design websites that fit different markets. Mandy Web Design serves real estate, corporate, medical, enterprise, healthcare, fashion, automotive, B2B, education, and many more industries. This wide industry exposure allows us to create websites that match your goals while keeping the design simple and effective.

Looking for a Full-Service Web Design Agency?

From custom design to responsive layouts, UI/UX, WordPress design, and maintenance, Mandy Web Design handles it all!

FAQs About Insurance Broker Website Design

Insurance broker website design is the process of creating a professional online presence for insurance brokers. It focuses on clean layouts, easy navigation, and functional features like quote forms and contact options, helping clients understand services and build trust before reaching out.

The cost of insurance broker website depends on complexity, features, and customization. At Mandy Web Design, web design starts at ₹13,000, including essential pages, mobile-friendly layouts, and contact forms, making it an affordable option for new or growing insurance businesses.

A professional insurance website design helps brokers showcase services, build credibility, and generate leads online. Most clients research policies and compare options online, and a clear, well-designed website ensures your business stands out and encourages visitors to get in touch.

Key features of an insurance website design include easy navigation, clear service pages, quote request forms, mobile responsiveness, secure data collection, and fast loading speed. These elements improve user experience, build trust, and make it easier for visitors to contact you.

Yes, a custom insurance website design can be created to match your brand, target audience, and business goals. Custom websites include unique layouts, advanced features like calculators, CRM integration, and tailored content, helping you stand out from competitors.

Mandy Web Design is an affordable web design company that focuses on practical solutions. With transparent pricing, insurance-focused layouts, responsive design, and ongoing support, we deliver professional websites without unnecessary features, helping brokers save money and grow their online presence.

Yes, Mandy Web Design provides website maintenance services including security updates, backups, plugin updates, and performance checks. Regular maintenance ensures your insurance website remains secure, fast, and functional, helping you maintain client trust and smooth operations.

Absolutely. Beyond insurance, Mandy Web Design builds websites for real estate, corporate, medical, enterprise, healthcare, fashion, automotive, B2B, education, and many more industries. Our experience ensures that every website is tailored to industry needs while remaining simple, professional, and conversion-focused.

About the Writer

Mandeep Singh Chahal

Founder/CEO, Mandy Web Design

Mandeep Singh Chahal is the Founder/ CEO of Mandy Web Design, a top-rated web design and development agency in India. With over 22 years of experience in digital marketing, he has helped businesses across various industries establish and strengthen their online presence through strategic design and SEO implementation. He focuses on creating digital solutions that address real business challenges and drive measurable growth. His approach combines deep industry knowledge with practical execution in web design, development, and search engine optimization, enabling him to transform business objectives into effective digital strategies that deliver results.